Venmo is a mobile payment service that allows users to easily transfer money to one another using their smartphones. Developed by Braintree and later acquired by PayPal(You can change your PayPal username), Venmo enables users to send and receive funds, split bills, and make purchases with friends and family. The app links to a user’s bank account, credit, or debit card, making transactions seamless and convenient.

Venmo is widely recognized for its social feed feature, which allows users to share transaction details and comments, adding a social aspect to financial transactions. This user-friendly interface and integration with social media have made Venmo a popular choice for quick and informal money transfers.

Table of Contents

Instant Venmo Transfers: Your Ultimate Guide to Sending and Receiving Money

With the surge in Venmo users over the past year, the question “Do you take Venmo?” has become increasingly common. Venmo, initially designed for casual transactions between friends, is now expanding into business payments, allowing users to pay for a wide range of goods and services. This user-friendly app connects to your bank account, making financial exchanges straightforward. Request money on Apple Pay using iPhone, Apple watch.

To send money, simply select the recipient, enter the amount and a note, and tap Pay. Requesting money is just as effortless: choose the recipient, input the amount and purpose, and hit Request. Whether you’re paying for dinner or handling business transactions, Venmo streamlines the process, making financial interactions smoother than ever.

Here’s a step-by-step guide to using Venmo for sending or receiving money:

Step 1. Open the App

Start by launching the Venmo app on your mobile device, as transactions can’t be done through the website.

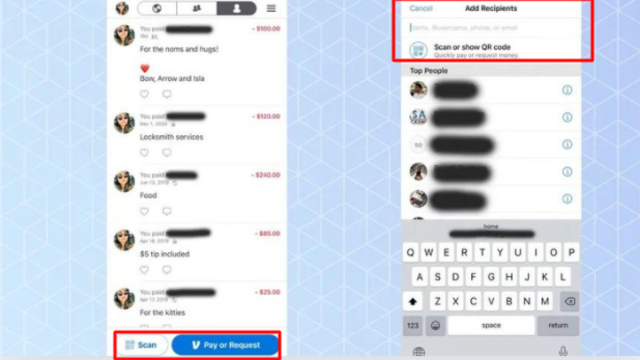

Step 2. Select “Pay or Request”

On the home screen, tap the “Pay or Request” button, which might appear as a pencil and square icon.

Step 3. Input the Name

Enter the username, phone number, or email of the person you’re paying or requesting money from. Double-check for accuracy to avoid sending funds to the wrong person.

Step 4. Specify the Amount

Type the amount you want to send in the field next to the recipient’s name.

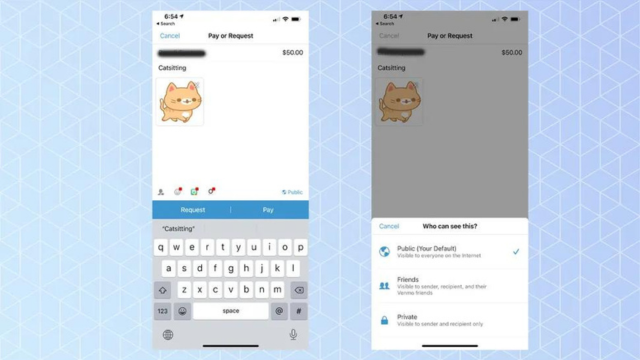

Step 5. Add a Note

In the “What’s it for” field, type a brief note explaining the transaction. You can also add emojis from the suggested options.

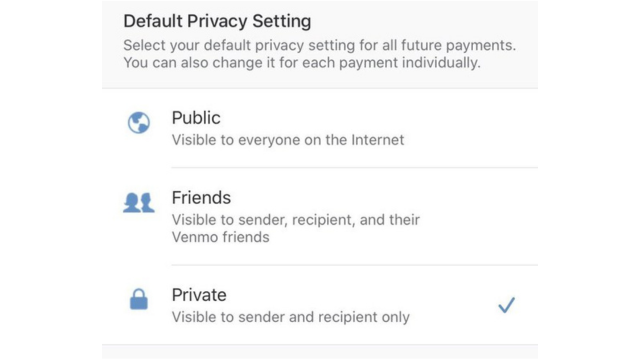

Step 6. Adjust Privacy Settings (Optional)

Tap the privacy setting at the bottom right to choose who can see the transaction: “Public” for everyone, “Friends” for just the sender, recipient, and their friends, or “Private” for only the sender and recipient.

Step 7. Choose Your Action

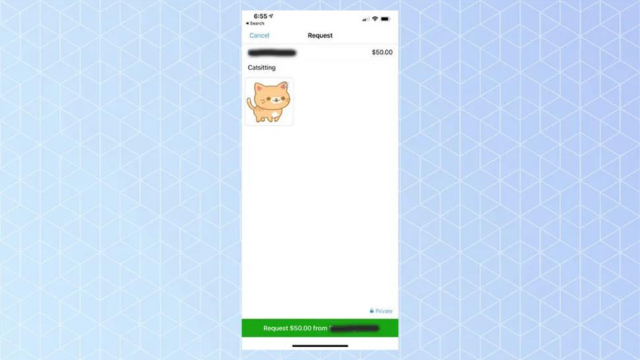

Tap “Request” or “Pay” in the blue bar, depending on your action.

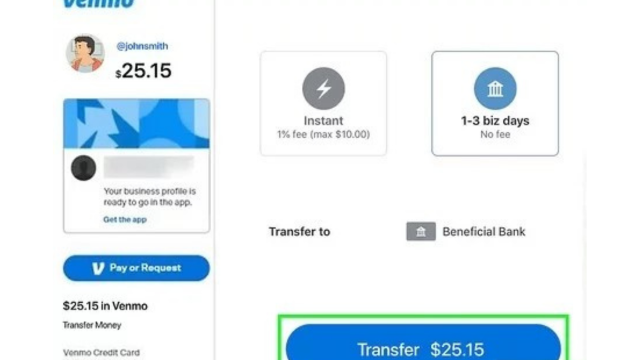

Step 8. Confirm the Transaction

Confirm the transaction by tapping the green confirmation bar that appears at the bottom of the screen.

Step 9. Verify via Email

Check your email for a confirmation of the transaction.

Conclusion

Using Venmo is a straightforward and efficient way to handle personal and business transactions. With just a few taps on your mobile device, you can quickly send or request money, add a note, and choose your privacy settings to control who sees the transaction. The app’s user-friendly design ensures that whether you’re splitting a bill with friends or paying for services, the process remains simple and secure. By following these easy steps, you can seamlessly manage your financial interactions and stay on top of your transactions with confidence.